Re-examining Bitcoin price collapses

Some years ago, when Bitcoin had a price collapse to $150, I advanced a theory about the danger of such a sudden drop and examined it a bit more last year. My predictions were wrong, but it's not yet entirely clear why they were wrong, and more people have started advancing similar theories.

In short, as Bitcoin (or other coins) mature, mining them should be a modestly profitable industry. If it gets too profitable, more people start mining, which bumps the difficulty and it becomes modestly profitable again. This works as it grows.

If it drops suddenly, though, all the marginally profitable miners (with older equipment) are suddenly unprofitable. By rational reasons they should turn off. If a whole lot of miners turn off quickly, the mining power (hashrate) drops suddenly, and the whole network slows down. It can take up to 2,000 blocks (2 weeks when the system is healthy) to correct the difficulty. If half the miners disappear it could take 4 weeks of slow network. Such an event might cause a panic. Then, when the difficulty corrected, a whole bunch of mining equipment would become profitable again, causing blocks to be mined too fast and a glut of mined coins, a dangerous yo-yo which the price has to change to compensate for. Volatility goes up and everybody gets scared.

But it has not happened. In fact, a year ago when the "halving" took place, there was not even a blip. The halving suddenly cut mining reward in half, as though the price of a bitcoin had suddenly halved as far as miners were concerned, though everybody knew this would happen years in advance. In theory, this cut should have made a ton of equipment instantly unprofitable, but as I said, there was not even a blip.

Mining for other than money

The main explanation I saw in the past is that a lot of the miners are doing so for other than the pure monetary reward as you might rationally see it. In particular, a lot of them are in China, and find that mining lets them turn electricity and mining rigs that they buy with RMB into bitcoins they can sell for $US without the currency controls of the Chinese government getting in the way.

It is not sufficient explanation that they are mining for the love of Bitcoin. If it costs you $4,000 in electricity to mine a bitcoin, and you can buy one on the exchanges for $3,400 there is no rational reason to mine.

It is different this time

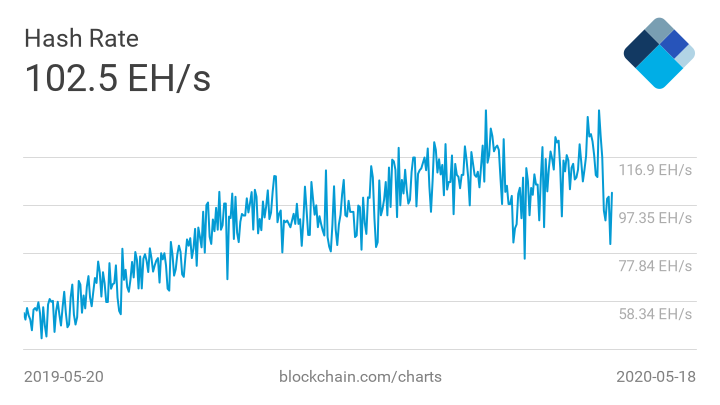

In the past, the price collapses and the halving did not cause the major decrease in the hashrate that they should have. That's not true today. These charts let you see the hashrate and you can see that the recent price drops have had the effect they should.

The key problem comes when the mining reward drops below the operating cost -- mostly electricity -- of large numbers of bitcoin mining rigs. Once you've paid for a rig, that cost is sunk, but with a big drop, it becomes unprofitable to have it powered on. This is making miners get taken offline. If the drop comes too fast in this more mature market, trouble may ensue.

As we can see, so far the miners have been vanishing more slowly. This gives the network time to adjust. But as I said, that adjustment can take 2 weeks (or possibly much more) if the price drop happens not long after the every-2-week interval.

It's not clear to me why the decline has been this gradual. There are only so many different brands of mining equipment out there. If they were all at the same electricity price, they would all become unprofitable at the same moment. They are not all at the same electricity price, and this may be what smooths out the curve and keeps the network alive. There may also be people who are slow to react.

There are also the BTC-billionaires who can't afford a collapse. It is worth it for them to lose money mining to keep the network stable, even if they lose money. They can do it for a while to assure there is no cliff.

Right now

If we look at one of the top-grade mining rigs today, the Dragonmint 16T which costs about $2800 to set up and draws about 1500 watts to provide 16 terahashes/second, that device currently can't pay for itself even if the electricity is free. It's only going to earn about $300 per year with free electricity at the current price and difficulty, which will never pay for the $2800. So nobody should be buying these right now, but lots of people own existing mining rigs, obviously -- there's 50 exahashes/second of capability out there.

However, even this efficient rig is losing money on the electricity at 3 cents/kwh, which is one of the lowest prices in the world. Only people set up next to efficient power plants with direct power deals pay this. If you pay 3 cents or more per kwh, it is not worth turning it on. And it gets less and less worth it if the price of the coins drops more. The only saviour is the drop in difficulty every 2 2000 blocks which will increase the mining rate. This is not a stable situation.

Comments

martin

Sat, 2018-12-08 02:09

Permalink

What about the influence of

What about the influence of renewable energy? If your mining rig is running off rooftop solar panels, then electricity cost is not a major driver, as the panel cost is all up front, and it's just a case of carrying on regardless. Unless it would be more profitable to switch to mining a different currency?

brad

Sat, 2018-12-08 11:54

Permalink

All the currencies are down

All the currencies are down, so switching is not a factor. Things do not "run off solar panels" unless you are off-grid, and it's both unwise and anti-green to be off grid. There are solar panels, and there are loads (like cars and bitcoin miners) but they are only loosely connected. If you have spare power, you sell it back to the grid and use that money to buy bitcoins if you want them. Now, the price the grid pays for your power does vary a lot, and there are some utilities who pay so little that it would make sense to run bitcoin miners during the sunny part of the day where you would otherwise sell it to the grid for a sucky price. But to be in that situation, you need to have so much solar that you actually generate more than you use, and that was kinda a silly thing to put in when the utility does not pay much for net back power.

So no, this is not having any influence, I suspect. Most of the major bitcoin miners have been putting themselves next to power plants so they can buy cheap power without transmission costs. That's who you are competing with.

Anonymous

Sun, 2018-12-09 13:06

Permalink

zero or negative power costs

Utilities themselves also own solar power, and one reason to overprovision solar might be due to governmental incentives. And solar's not the only form of energy production that can sometimes have zero marginal cost. In fact, sometimes power prices go negative as it's more costly to shut down power production than it is to use it up. Another thing to consider is that a major bitcoin miner that builds an operation next to a power plant is likely going to have contractual minimum purchases.

These factors don't explain all the differences between a simplified theory and reality, but I don't think you can dismiss them as having zero influence.

brad

Mon, 2018-12-10 00:31

Permalink

How much influence

The question is whether a large amount of bitcoin mining is done by mining rigs connected to solar panels which have nowhere else to sell their power. I have seen no evidence this is common at all, let alone large.

Bitcoin miners might be connected to power plants that let the price go negative (coal/nuclear) but this normally only happens at night. Negative power is great but really what the miner cares about is their total power bill for the day, not just the price at night.

However, once a mining rig is no longer cost effective in the day, it might very well turn on only at night. But that means a serious drop in its total hash power.

Paul Pluzhnikov

Sat, 2018-12-08 23:14

Permalink

typos

"halving" to ok place -> "halving" took place

terrahashes -> terahashes

cxed

Mon, 2018-12-10 14:30

Permalink

The always profitable mining rig

Of course the mining rigs that never stop being profitable are the ones that are stolen. Stolen AWS is ideal, but it can be anything - a lame phone app mining in the background, bot net, etc. And then there's money laundering where the BTC depreciation is just like a higher service fee.

brad

Tue, 2018-12-11 09:58

Permalink

Stolen mining

My guess is that the fraction of the global hashrate from stolen gear is low. In fact, I think that almost all the hashrate is professional mining farms at this point. And while you can't secure ordinary computers, dedicated ASIC rigs are easier to secure.

Add new comment